Reduce term of mortgage calculator

Based on a 200000 mortgage at a fixed 3 APR you can save over 5000 if you make an overpayment of 50 per month. Choose the frequency with which you repay your loan keeping in mind that more frequent mortgage repayments will reduce the interest paid as well as the life.

Mortgage With Extra Payments Calculator

Factors in Your North Carolina Mortgage Payment.

. Even bi-annual payments of significant size can reduce the term of the loan and the total interest paid. Using the calculator above lets estimate your monthly principal and interest payment total monthly payment total interest cost and ending balloon payment. Property taxes are one of the first things to consider as an added cost to homeownership.

By choosing to offset your savings of currentSavings and reduce the term of your mortgage we will collect the monthly mortgage of savingsMonthly as normal. This is the 17th-lowest state effective tax rate in the nation. The mortgage calculator lets you test scenarios to see how you can reduce the monthly payments.

Martins FREE Printed Mortgage Help Booklets. This calculator will help you to measure the impact that a lump sum repayment made at a certain period into the loan will have on the length of your mortgage and the total interest paid. Find out more about reducing your mortgage term.

A monthly payment is multiplied by 12 resulting in 360 payments. This mortgage calculator is a well-equipped loan calculator that deals with multiple questions arising when you are about. The most effective way to moderate the financial cost of your mortgage is to reduce the balance of the principal and so shorten the amortization term.

A mortgage in itself is not a debt it is the lenders security for a debt. Select your loan term from the drop-down menu. Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage.

You must make the balloon payment by the end of the 3-year term. First they can see how much their new mortgage payment is. Now the shorter 15-year term will make Tom and Pattys monthly payment go up from 1150 to about 1300 per month and itll make yours go up a little too.

If you have a 30-year mortgage you can refinance to a 15-year mortgage with reduced interest. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. The number of years over which you will repay this loan.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The term of the loan can affect the structure of the loan in many ways. This is also calculated using the.

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. In the More Options input section of the calculator is an Extra Payments section to input monthly yearly or single payments. The mortgage calculator lets you test scenarios to see how you can reduce the monthly payments.

For a biweekly payment a 30-year term is multiplied by 26 resulting in 780 payments. A loan term is the duration of the loan given that required minimum payments are made each month. The mortgage calculator result helps Tom and Patty do two things.

We will then deduct any offset benefit from the capital balance thus your mortgage term would reduce by timeReduction. Odd-job worker freelancer commission-based income the bank will reduce your annual income due to fluctuations and uncertainty. Generally the longer the term the more interest will be accrued over time raising the total cost of the loan for borrowers but reducing the periodic payments.

This calculator assumes you reduce the mortgage debt which is the main benefit of overpaying. The maximum mortgage calculator will allow you to input your monthly obligations your monthly income to calculate the maximum monthly mortgage payment. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

If you want to reduce your term you will need to speak to one of our mortgage advisers to discuss your options. While the 30-year mortgage is the most popular term in. On the other hand if you want to reduce your principal faster you can go for an accelerated biweekly payment schedule.

Use a mortgage refinance calculator to determine the breakeven point which is the number of months it takes for the savings to outweigh the cost of refinancing. Extend the term the number of years it will take to pay off the loan. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI.

The mortgage APR takes all of these into account and expresses them in terms of an. This free online calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment once a month. First Time Buyers Guide Printed or PDF Mortgages.

The loan term represents the number of years itll take you to repay your. Divide the breakeven timeframe months by 12 to calculate the number of years you need to make payments on the loan before realizing any savings from the refinance. N the total number of payments.

Input the interest rate you expect to pay on your mortgage. Fixed rate - the interest rate will stay the same throughout the. Discount points in particular can reduce your rate but mean much higher costs up front.

Principal Years Start month Start year Interest o oo ooo 18 Payment Year Year Summary. Making prepayments can potentially shorten the loan term and reduce the interest payments. When the next monthly payment recalculation happens for example at an interest rate change the monthly payment will be calculated using the existing remaining term of the mortgage.

The loan amount is 800000 with an 8 percent APR. Select the duration of the loan. Also ensure that any overpayment you make goes to reduce the debt so shortening the term rather than reducing your monthly payments.

Malaysia home loan eligibility calculator to calculate your maximum housing loan amount in 2021 based on your annual income and ability to service the loan. If you make higher overpayments you can further shorten your loan term and reduce your interest costs. Use the results to see how much can be saved by making extra payments in terms of interest paid as well as the reduction in loan.

Extend the term the number of years it will take to pay off the loan. Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment. It will also remove more than 1 year off a 25-year mortgage term.

You can decrease your loan term and acquire a lower interest rate to pay your mortgage early. The most common mortgage terms are 15 years and 30 years. Consider this example if you want to maximise your savings.

Moreover it allows you to shift from a fixed-rate mortgage to. In North Carolina you can expect to pay roughly 077 of your home value. Get 247 customer support help when you place a homework help service order with us.

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Downloadable Free Mortgage Calculator Tool

Online Mortgage Calculator Wolfram Alpha

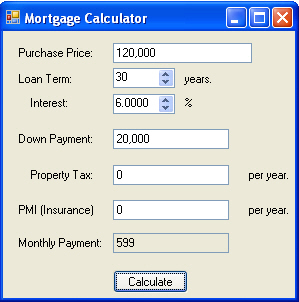

Mortgage Calculator With Down Payment Dates And Points

Mortgage Recast Calculator To Calculate Reduced Payment Savings

Mortgage Calculator How Much Monthly Payments Will Cost

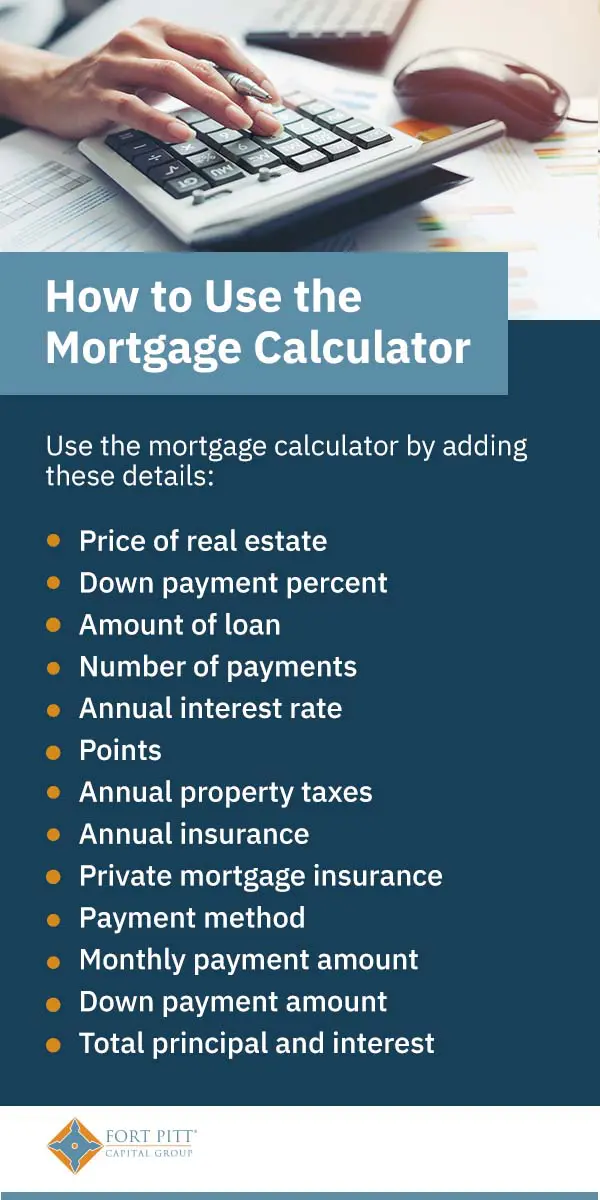

How To Use A Mortgage Calculator

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Mortgage Calculator How Much Monthly Payments Will Cost

Mortgage Calculator Money

Extra Payment Mortgage Calculator For Excel

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

5 Alternative Ways To Use A Mortgage Calculator Zillow

Mortgage Calculator In C And Net

Va Mortgage Calculator Calculate Va Loan Payments

Mortgage Calculator Estimate Your Monthly Payments

Discount Points Calculator How To Calculate Mortgage Points