43+ how to calculate paying off mortgage early

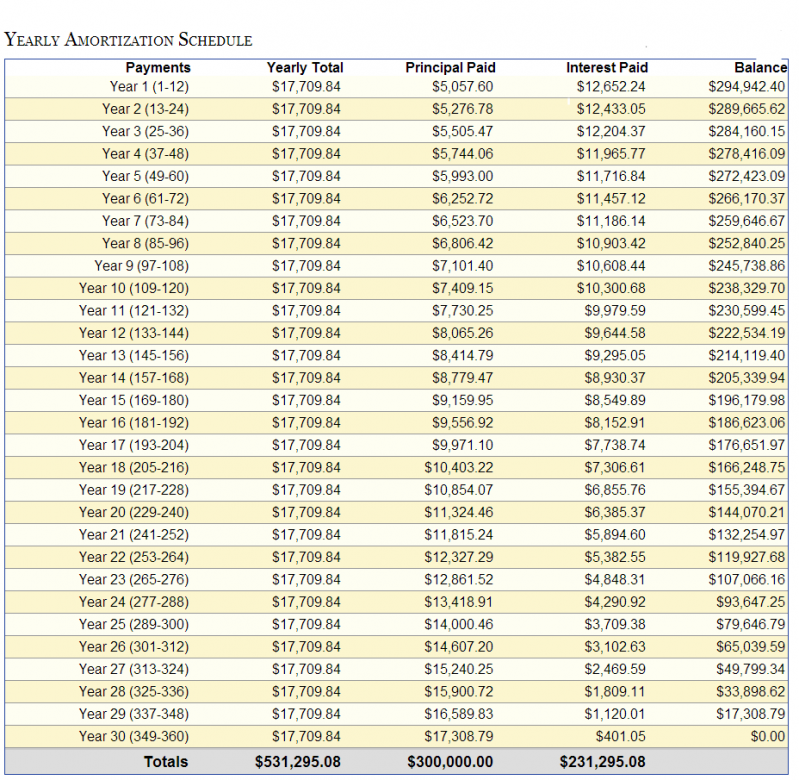

Web Our Early Mortgage Payoff Calculator will help determine your new monthly mortgage payments required to reduce your amortization period based on your mortgage balance mortgage rate and current payments. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Mortgage Payoff Calculator Interest Com

Web The mortgage calculator for early mortgage payoffs is one of several financial tools aimed to help existing and prospective homeowners alike.

. You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type desired. Web Find out how much interest you can save by paying an additional amount with your mortgage payment. Rent Or Buy Calculator.

Web The early mortgage payoff calculator will have a number of boxes or fields for you to fill in with your specifics including mortgage loan amount your annual interest rate the mortgage loan term in years your annual real estate taxes and homeowner insurance along with your private mortgage insurance PMI. This early loan payoff calculator will help you to quickly calculate the time and interest savings the pay off you will reap by adding extra payments to your existing monthly payment. Web Early Loan Payoff Calculator for Calculating Savings with Extra Payments.

Make extra payments There are two ways you can make extra mortgage payments to accelerate the payoff process. Mortgage Calculators Mortgage Calculator Affordability Calculator Early Pay-Off Calculator Interest Only Calculator Advanced Mortgage Calculator Mortgage Refinance Calculator Mortgage. Biweekly mortgage payments The first way.

Our mortgages section has lots more information on mortgages and paying extra off your mortgage. Then enter the loan term which defaults to 30 years. Estimate your monthly mortgage payment.

By adding an additional payment on top of your monthly payment you can pay off your mortgage faster and reduce your total interest. Early Mortgage Payoff Calculator. Web 5 ways to pay off your mortgage early 1.

The additional amount will reduce the principal on your mortgage as well as the total amount of interest you will pay and the number of payments. Make sure you already know or have the following handy. Original mortgage loan amount.

Web 1 to 40 years Mortgage type Repayment Interest Only Interest rate or Monthly payment Note. How Much Interest Can You Save By Increasing Your Mortgage Payment. To use it simply.

Take Advantage of Low VA Loan Rates. Credit Card Payoff Calculator. Discover The Answers You Need Here.

Web To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan. Web If you want to pay a lump sum off your mortgage or start paying more every month use this calculator to see how much money you could save and whether you can shorten the term of your mortgage. Web Mortgage Early Pay Off Calculator - Work out the impact of paying off your mortgage early with our simple to use and free calculator.

Web How to Obtain a Payoff Quote. Work out the daily interest rate by multiplying the loan balance by the interest rate then dividing that by 365. The calculator also includes an optional amortization schedule based on the new.

You can calculate a mortgage payoff amount using a formula. Web How to Use This Mortgage Payoff Calculator Before you start youll need to gather some information. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Input the property price and the total mortgage cost current Add the total term duration from time the current time to expiration and desired term duration. Ad If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Ad See how much house you can afford.

This figure multiplied by the days until payoff plus the loan balance gives you your mortgage payoff amount. How Much Interest Can You Save By Increasing Your Mortgage Payment. Determine all loan application information needed to calculate for an early mortgage payoff.

Typically youre only allowed to overpay by 10 of your outstanding mortgage balance per year so bear this in mind in particular if you wish to make recurring overpayments more than once a year. Ad Competitive Interest Rates And No Private Mortgage Insurance Mean Lower Monthly Payments. Include the principal loan amount repayment period remaining years for repayment and the fixed mortgage interest rate.

Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Apply Today and Get Pre-Approved In Minutes. One-off overpayment andor Recurring.

Should I Pay Off My Mortgage Early Saverocity Finance

Free 10 Business Debt Schedule Samples In Pdf Ms Word

Think Twice Before Paying Off Your Mortgage Early Knowledge At Wharton

Early Mortgage Payoff Calculator Be Debt Free Mls Mortgage

Save Win And Secure With Al Dana Doha Bank Qatar

3 Powerful Strategies To Pay Off Your Mortgage Early

43 Mortgage Broker Tools For Boosting Productivity

Solution You Can Afford A 1450 Per Month Mortgage Payment You 39 Ve Found A 30 Year Loan At 8 Interest A How Big Of A Loan Can You Afford B How Much Total

Early Mortgage Payoff Calculator Repay Your Home Loan Early

How To Pay Off A 30 Year Mortgage In 15 Years Debt Org

Should You Pay Off Your Mortgage Before Retirement There Are Pros And Cons

Mortgage Payoff Calculator Ramsey

Early Mortgage Payoff Calculator Repay Your Home Loan With Extra Payments

43 Ac Shillelagh Rd Chesapeake Va 23323 Mls 10402185 Redfin

Astrology And Athrishta K P 12 Issues 1964 Pdf Pdf Planets In Astrology Horoscope

43 Acres Highway 15 North Clarksville Va 23927 Mls 65083 Listing Information Long Foster

Mortgage Calculator Ramsey